上 inverted treasury yield curve chart 280769-Inverted treasury yield curve chart

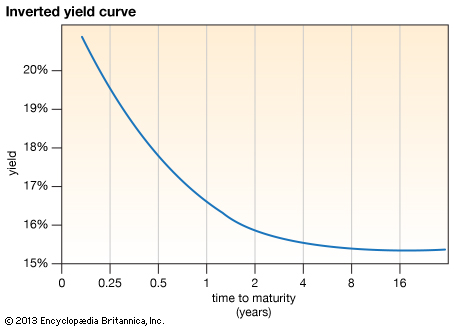

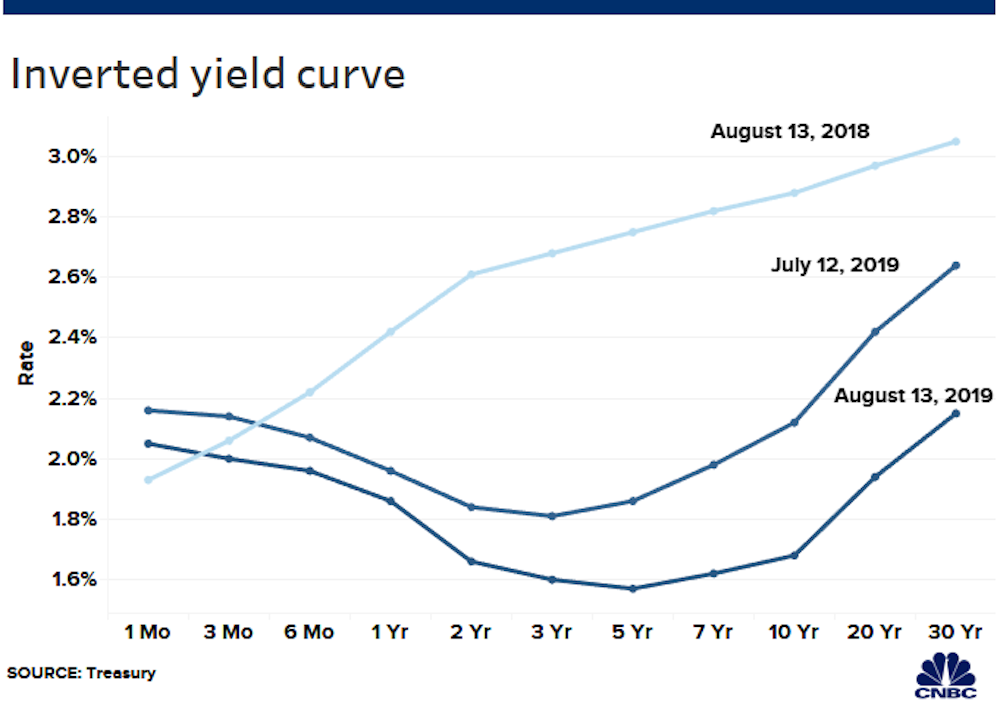

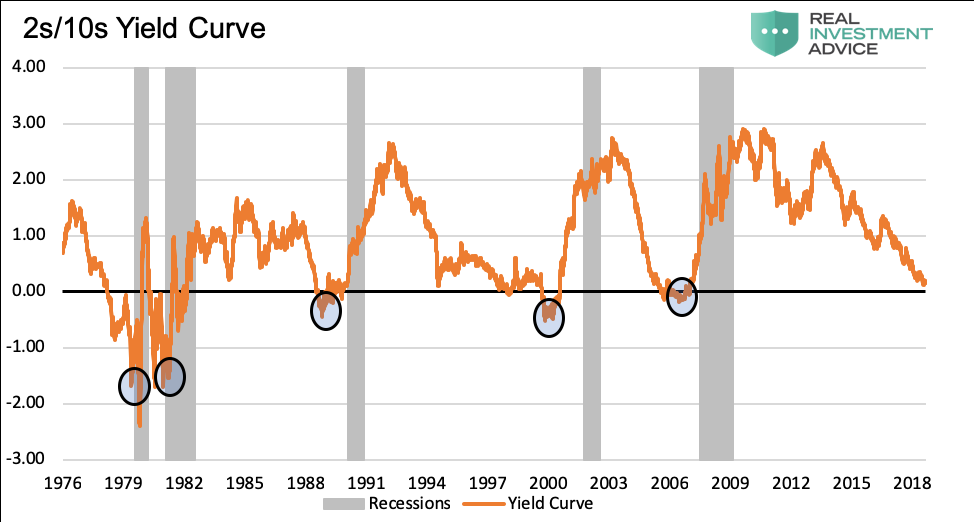

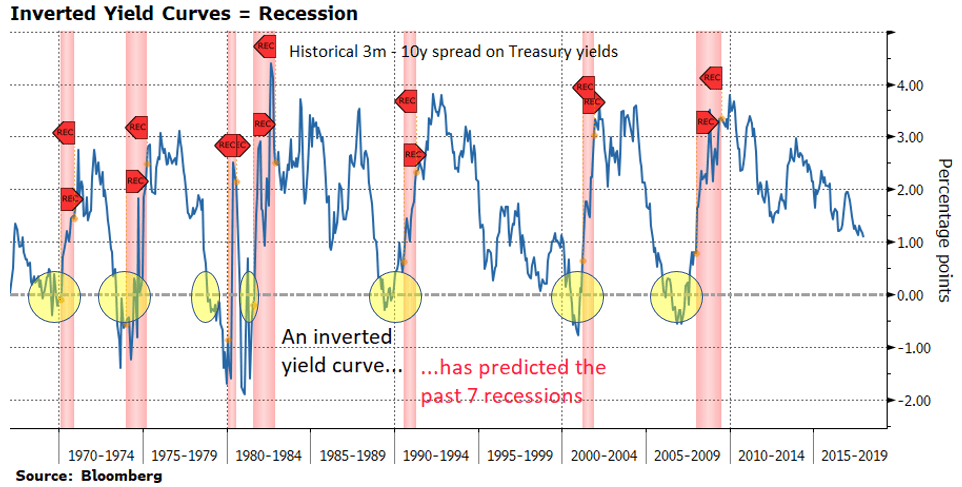

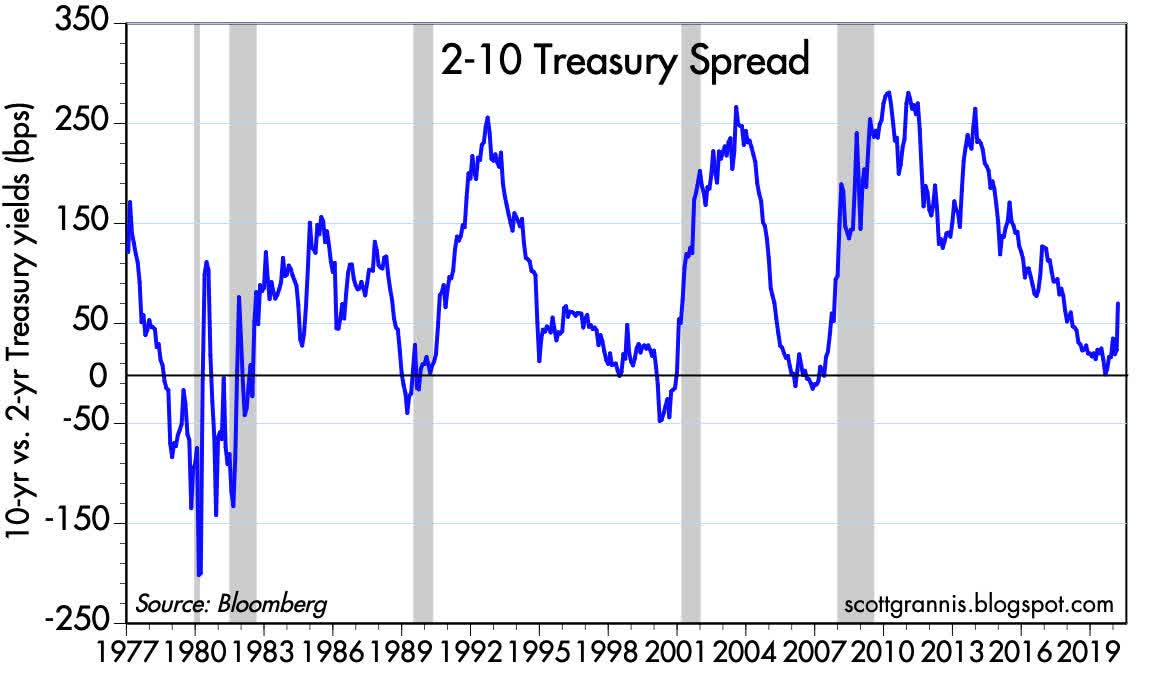

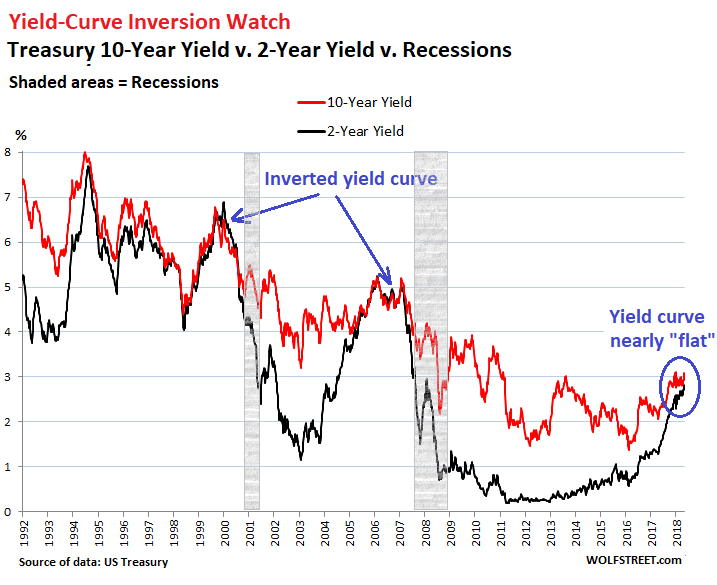

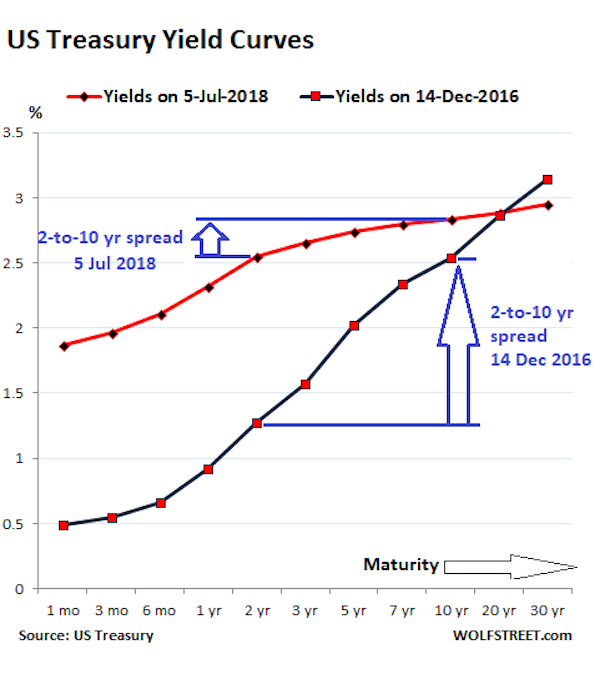

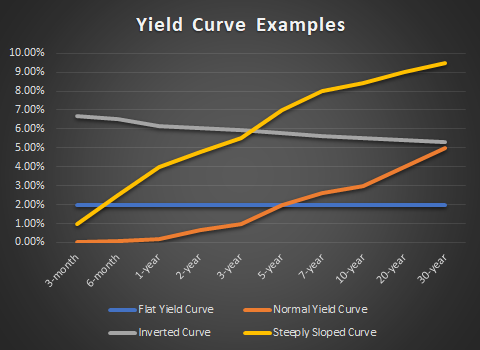

An inverted yield curve does not cause an economic recession Like other economic metrics, the yield curve simply represents a set of data However, the yield curve between two and tenyear Treasury bonds correlates with the economic recessions of the past forty years An inverted yield curve appeared about a year before each of these recessionsGraph and download economic data for from to about 2year, yield curve, spread, 10year, maturity, Treasury, interest rate, interest, rate, and USAYesterday the yield curve inverted the interest rates on 10year treasury bonds were briefly lower than the interest rates on 2year bonds But that's not a curve

Recession Watch What Is An Inverted Yield Curve And Why Does It Matter The Washington Post

Inverted treasury yield curve chart

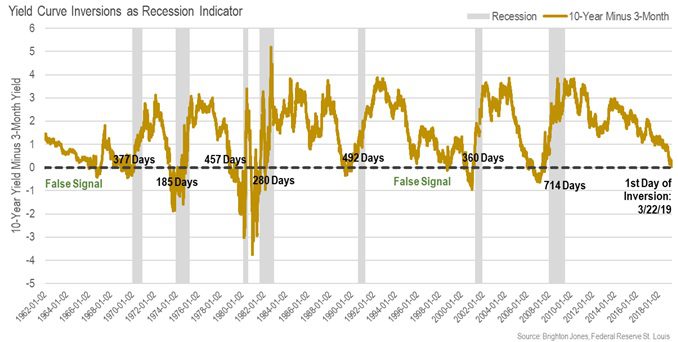

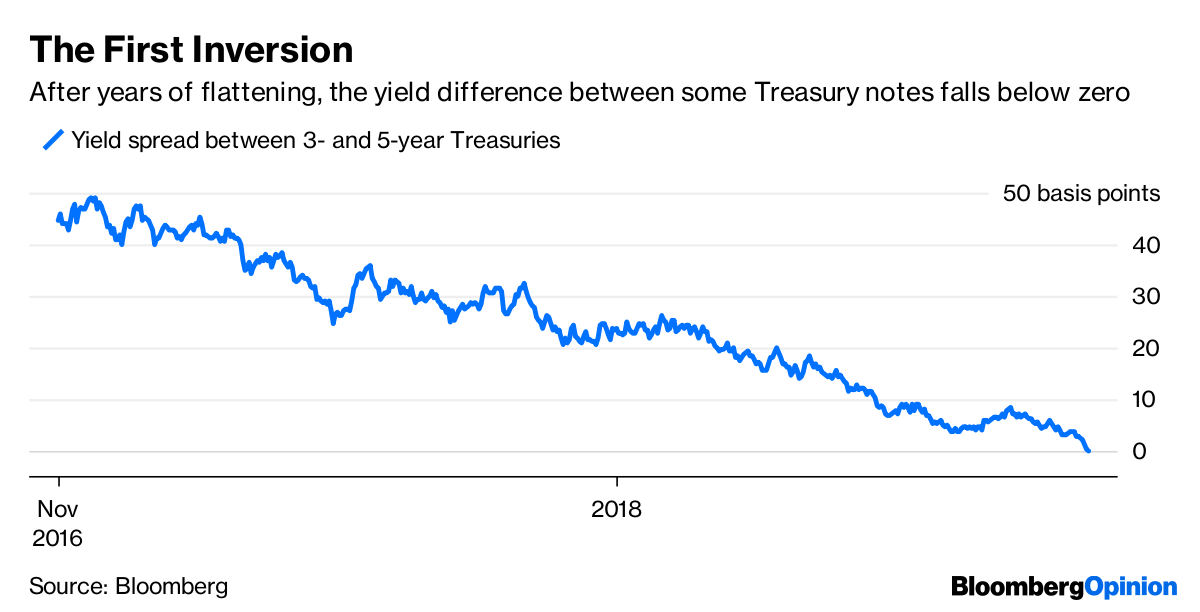

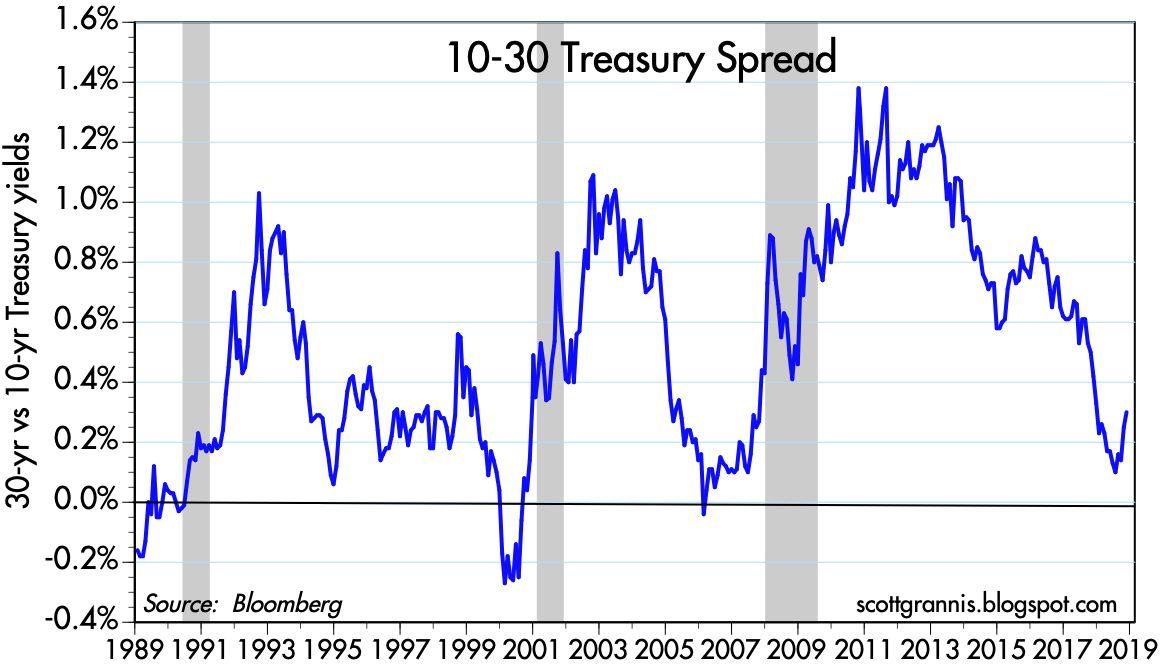

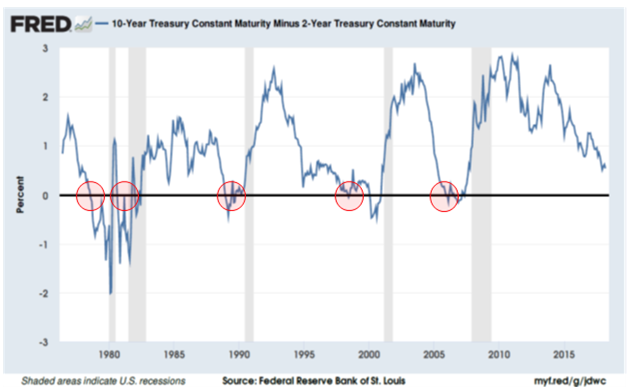

Inverted treasury yield curve chart-These charts display the spreads between longterm and shortterm US Government Bond Yields A negative spread indicates an inverted yield curve In such a scenario shortterm interest rates are higher than longterm rates, which is often considered to be a predictor of an economic recessionAn inverted yield curve does not cause an economic recession Like other economic metrics, the yield curve simply represents a set of data However, the yield curve between two and tenyear Treasury bonds correlates with the economic recessions of the past forty years An inverted yield curve appeared about a year before each of these recessions

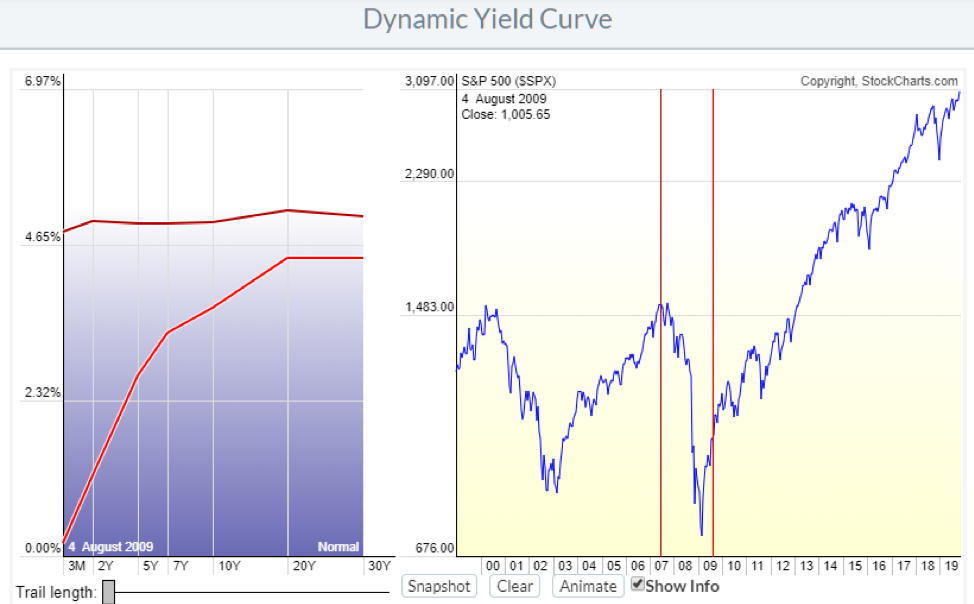

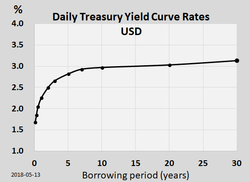

Animating The Us Treasury Yield Curve Rates

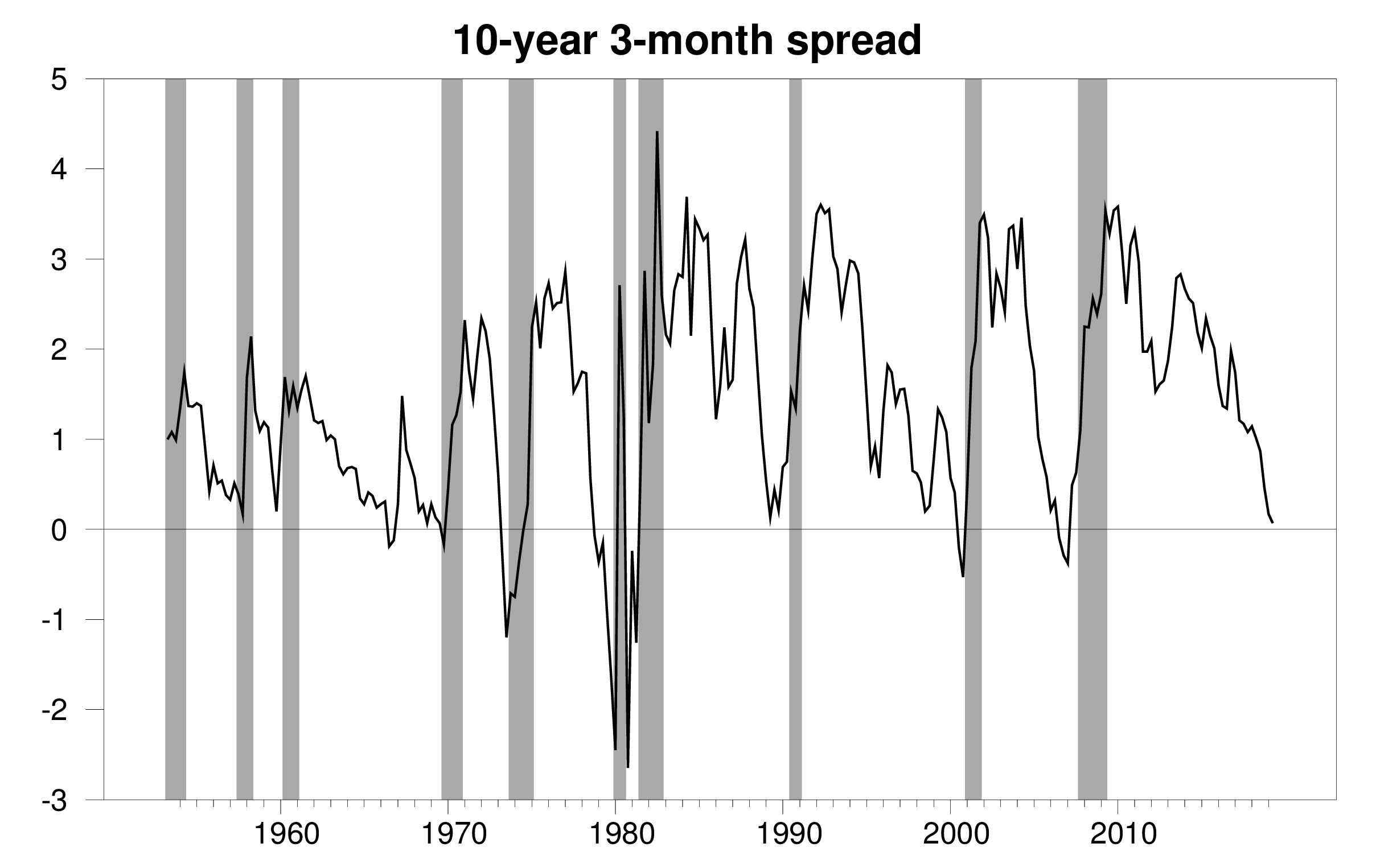

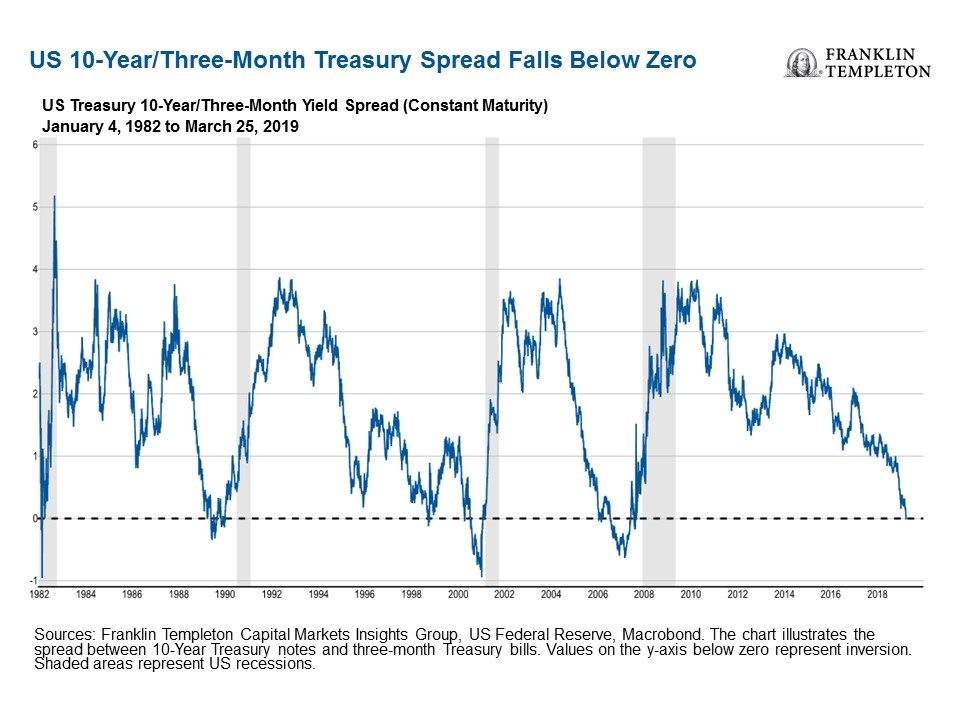

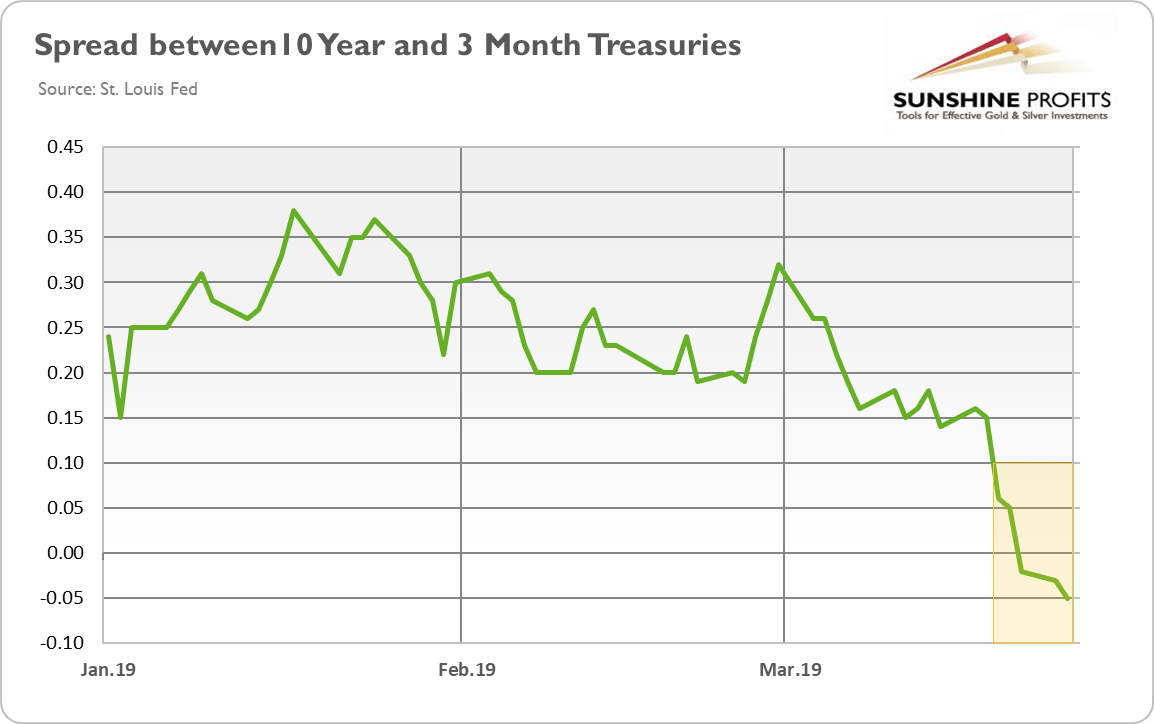

Interpretation The charts above display the spreads between longterm and shortterm US Government Bond Yields The flags mark the beginning of a recession according to Wikipedia A negative spread indicates an inverted yield curveIn such a scenario shortterm interest rates are higher than longterm rates, which is often considered to be a predictor of an economic recessionChart 1 Yield curve (spread between US 10year and 3month Treasuries, daily numbers, in %) in 19 The inversion of the yield curve is of crucial importance as it has historically been one of the most reliable recessionary gauges Indeed, the inverted yield curve is an anomaly happening rarely, and is almost always followed by a recessionYesterday the yield curve inverted the interest rates on 10year treasury bonds were briefly lower than the interest rates on 2year bonds But that's not a curve

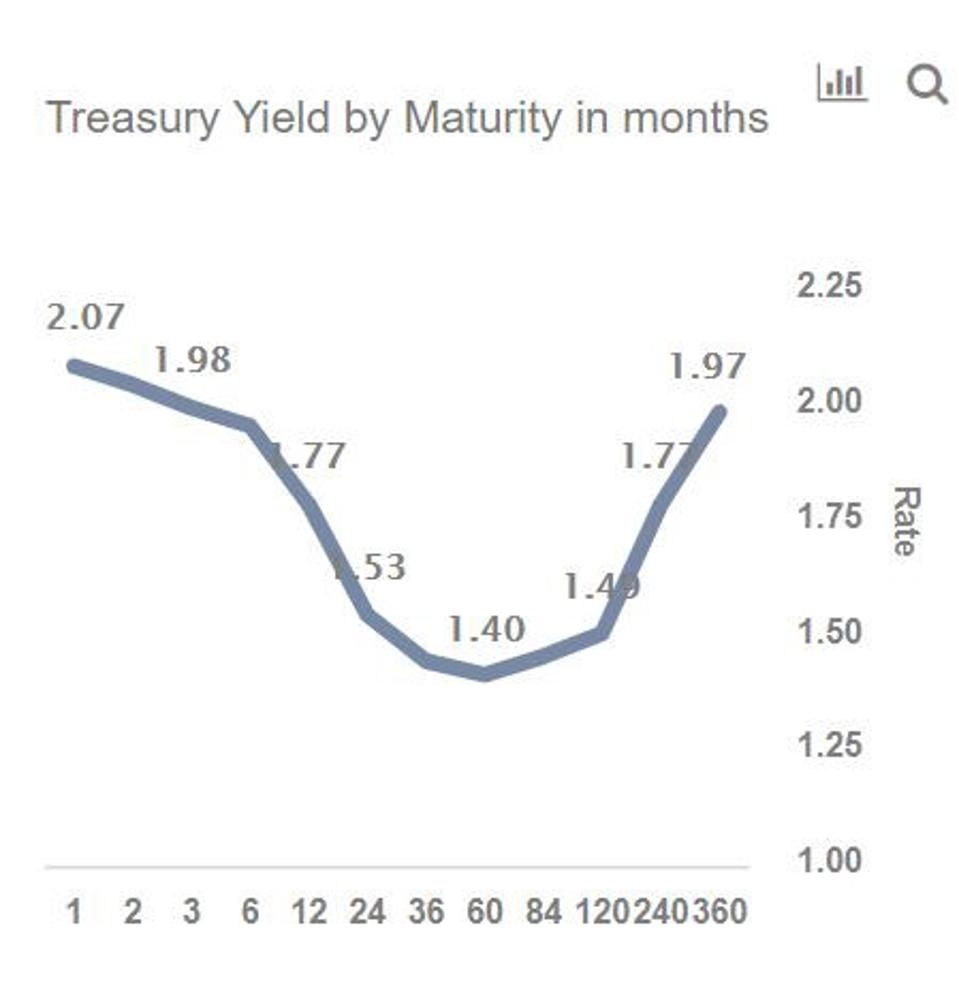

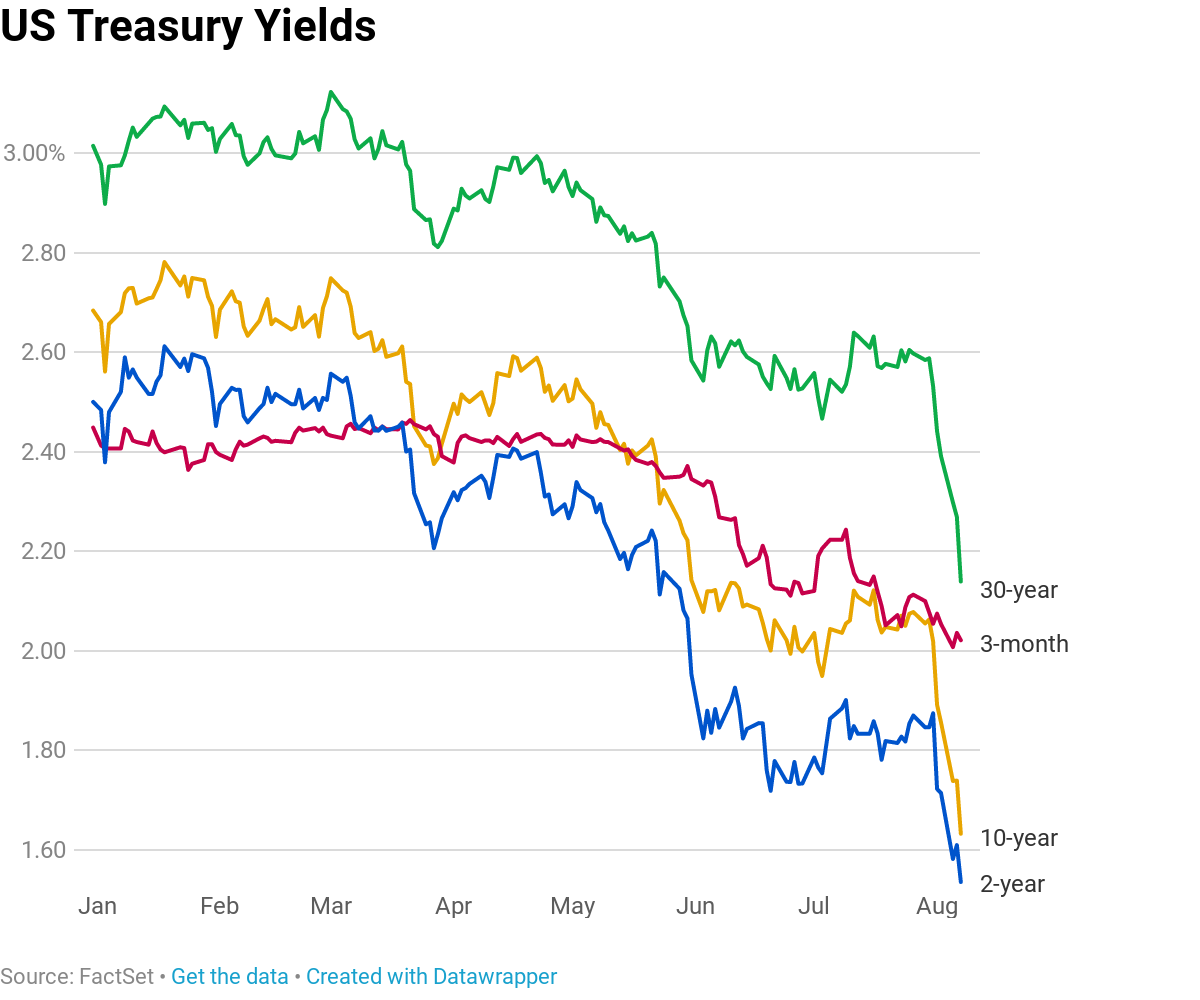

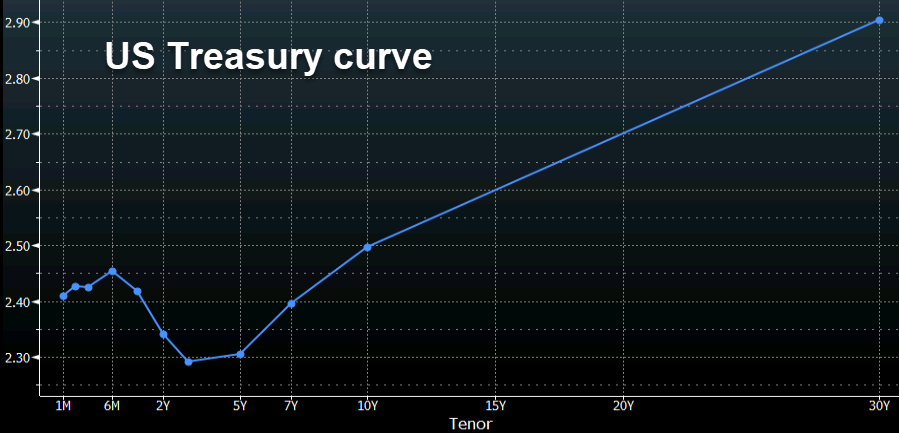

The yield curve flattened over the summer as fear swept the market But now as it goes the other way, sentiment may improve in major banking stocks The yield curve is the relationship between the twoyear and 10year Treasury notes People buy 10year notes when they're scared or worried about a recessionThe US Treasury yield curve inverted again, with 3month Treasury bills holding a higher yield (156%) than 10year Treasury notes (146%) The big picture This is the second time the yield curve has inverted in a matter of weeks, and the third time in a matter of months It's the deepest the yield curve has been inverted since Oct 9The gap between the yields on shortterm bonds and longterm bonds increases when the yield curve steepens The increase in this gap usually indicates that yields on longterm bonds are rising faster than yields on shortterm bonds, but sometimes it can mean that shortterm bond yields are

The US Treasury yield curve inverted again, with 3month Treasury bills holding a higher yield (156%) than 10year Treasury notes (146%) The big picture This is the second time the yield curve has inverted in a matter of weeks, and the third time in a matter of months It's the deepest the yield curve has been inverted since Oct 9In the end of January 21, the yield for a twoyear US Treasury bond was 014 percent, slightly above the one year yield of 008 percent Bonds of longer maturities generally have higher yieldsIndex trading charts all time frames Follow me on Twitter @thinktankcharts Over ,000 Followers Generally, I go over the charts daily AutoSize Charts !

19 S Yield Curve Inversion Means A Recession Could Hit In

1

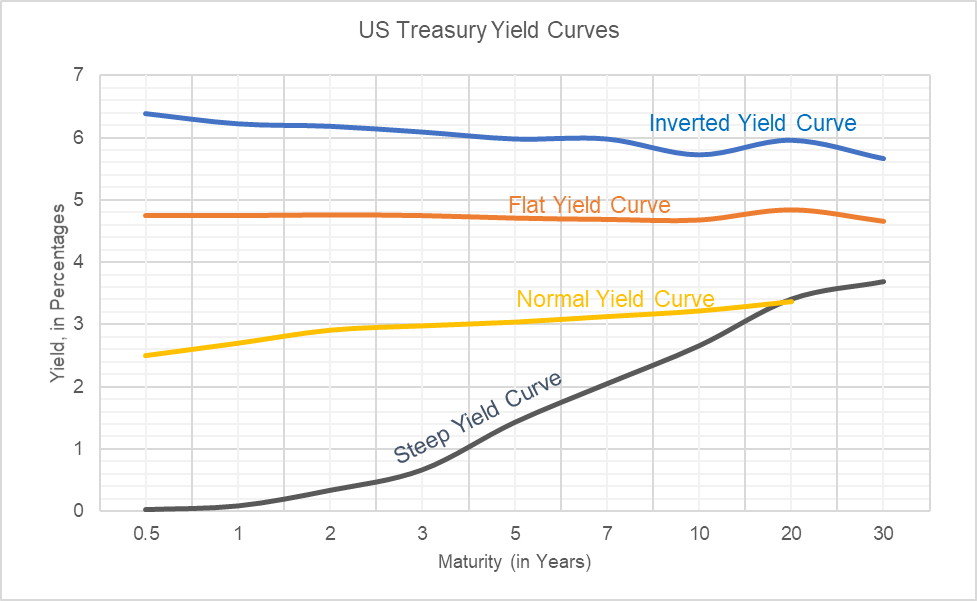

S&P 500 Top and Bottom Finder 2 Back to All Public ChartLists report offensive material 10 Per Page View ChartBook ViewNormal Yield Curve Interest Rates The chart and the table below capture the yield curve interest rates as available from the US Department of the Treasury The yield curves correspond to five different dates from five different years It can be seen that the yield curve for 29Dec17, 31Dev18, and 31Dec19 are normal in natureInverted Yield Curve What Is a Steep Yield Curve?

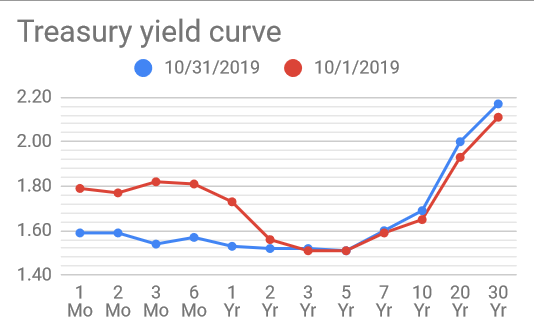

Treasury Yield Curve Changes For October 19 Bogleheads Org

Inverted Yield Curve Everything You Need To Know Centurion Wealth

Public ChartLists on StockChartscom Market data provided by Xignite, IncCommodity and historical index data provided by Pinnacle Data CorporationCryptocurrency data provided by CryptoCompareUnless otherwise indicated, all data is delayed by 15 minutesAn inverted yield curve marks a point on a chart where shortterm investments in US Treasury bonds pay more than longterm ones When they flip, or invert, it's widely regarded as a bad sign forA yield curve is a chart showing the interest rates for bonds with equal credit quality but different maturity dates The yield curve most commonly cited shows threemonth, twoyear, fiveyear, 10

Yield Curve Inversion Chart 10y 2y Spread

Understanding Treasury Yield And Interest Rates

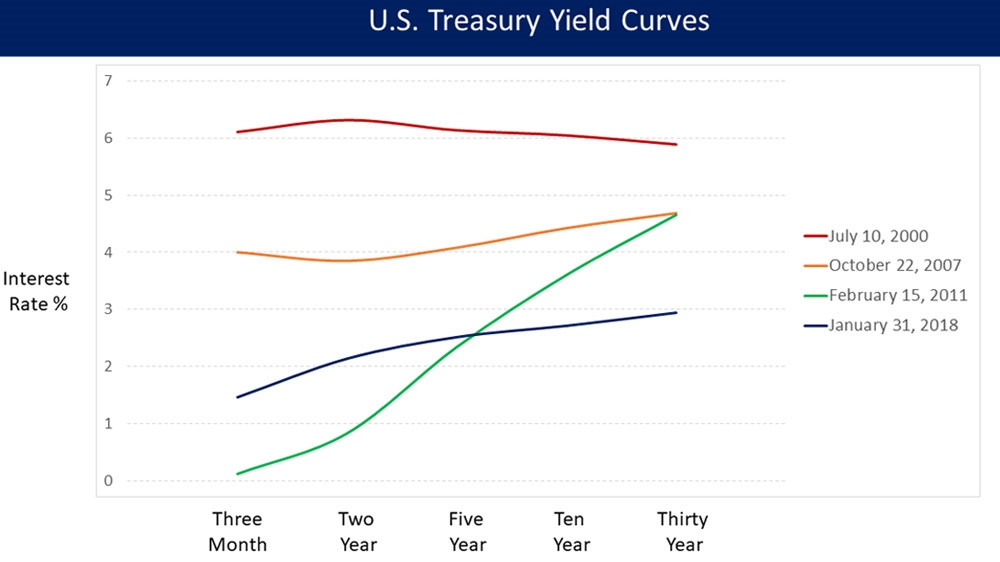

Normal Yield Curve Interest Rates The chart and the table below capture the yield curve interest rates as available from the US Department of the Treasury The yield curves correspond to five different dates from five different years It can be seen that the yield curve for 29Dec17, 31Dev18, and 31Dec19 are normal in natureGraph and download economic data for from to about 2year, yield curve, spread, 10year, maturity, Treasury, interest rate, interest, rate, and USAThe inverted yield curve is a graph that shows that younger treasury bond yields are yielding more interest than older ones And it's TERRIFYING for financial pundits all over the world It's a graph that could mean the difference between a thriving bull market or the downswing of a bear market

Inverted U S Yield Curve Points To Renewed Worries About Global Economic Health Marketwatch

What An Inverted Yield Curve Does And Doesn T Mean Brighton Jones

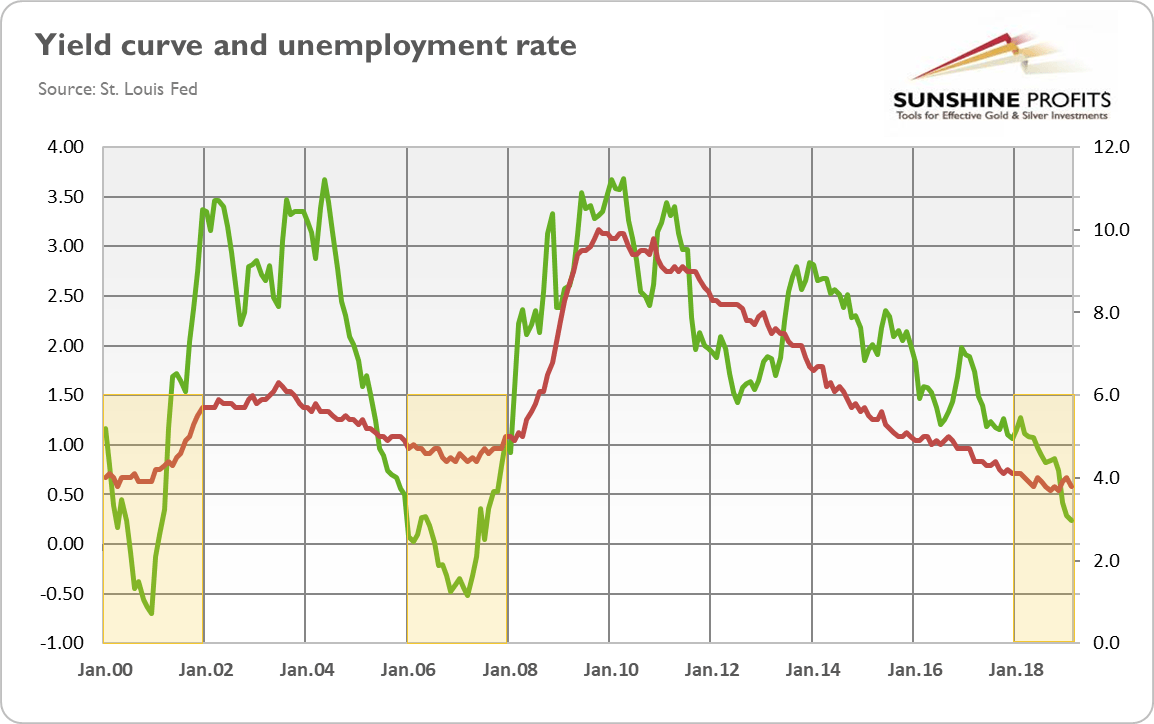

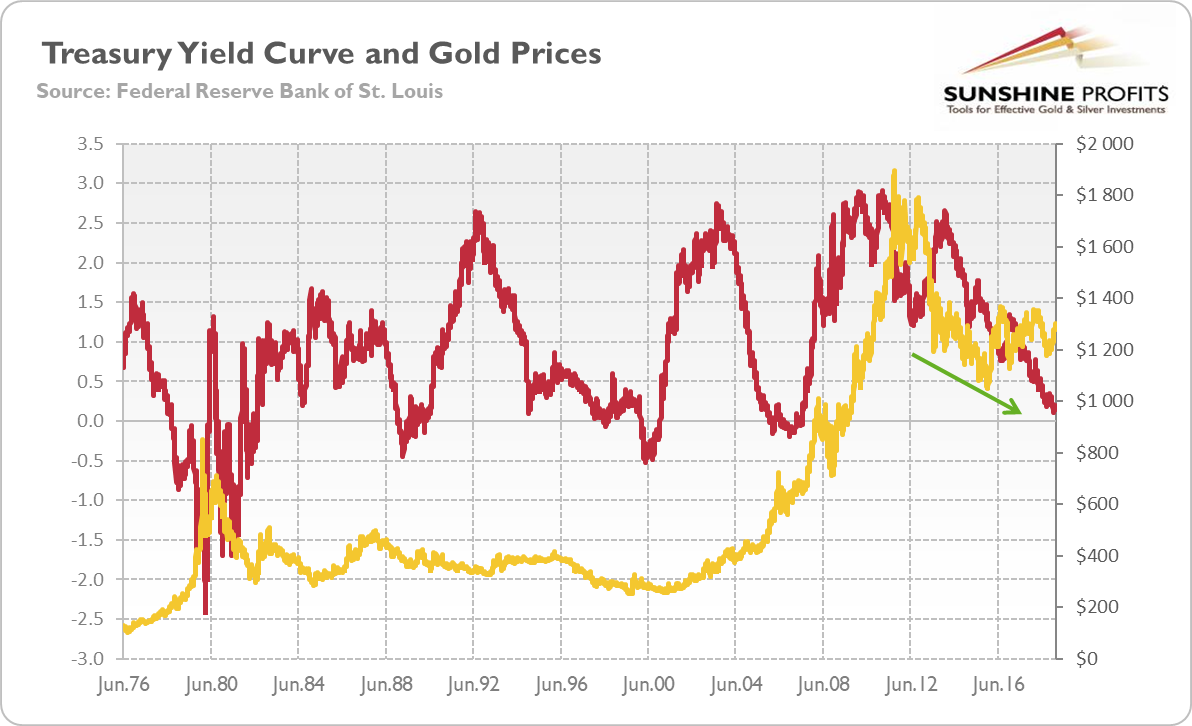

And the yield curve becomes inverted when the longer term interest rates move below the shorter term interest rates Such changes may be important for the gold market Yield Curve and Gold Let's look at the chart below, which shows the price of gold and the Treasury yield curve, represented by the spread between 10year and 2year TreasuryInverted yield curve, we consider the curve inverted when the yield differential between the two and 10year Treasury notes becomes negative For simplicity, we will focus on the monthend yield spreads of the two data series Historical Averages As Table 1 indicates, the yield curve inverted eight times, for at leastImpact of the Corporate Bond Yield Curve Historically, the inverted yield curve is a leading indicator of a recession, as mentioned previously When shortterm interest rates rise above longterm rates, the market sentiment indicates that the longterm prospects are poor And that the longterm yields offered for corporate or Treasury bonds

Inverted Yield Curve What Is It And How Does It Predict Disaster

This Leading Indicator Points To Another Yield Curve Inversion Soon Kitco News

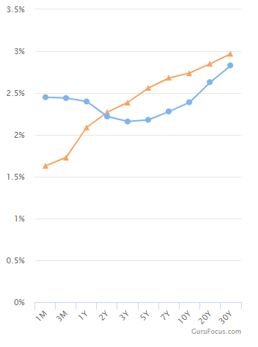

The 10Y2Y spread is plotted below the chart Orange circles show dips below the zero line, which is where the yield curve is inverted Notice that there is a yield curve inversion preceding every period of contraction since the late 1970s As predicted by the table above, the yield curve is typically inverted or flat at the beginning of aAs shown in the chart below (based on data from August 27, 19), the yield curve was inverted as shortterm interest rates (1 and 2 month maturity) were higher than the longterm rates (36–84In a flat yield curve, shortterm bonds have approximately the same yield as longterm bonds An inverted yield curve reflects decreasing bond yields as maturity increases Such yield curves are harbingers of an economic recession Figure 2 shows a flat yield curve while Figure 3 shows an inverted yield curve GuruFocus Yield Curve page highlights

Inverted Yield Curve Suggesting Recession Around The Corner

Macro Musings Blog Fomc Preview We Have The Nerve To Invert The Curve

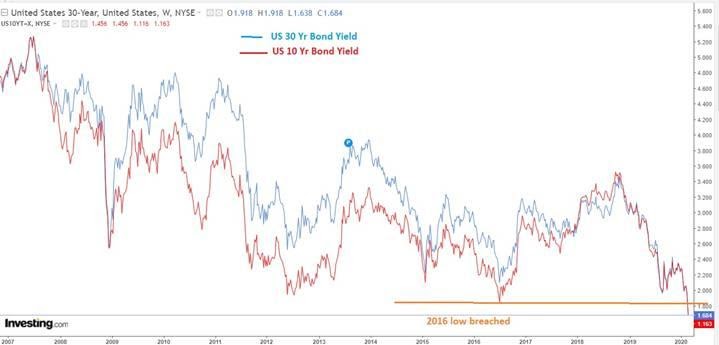

An inverted yield curve does not cause an economic recession Like other economic metrics, the yield curve simply represents a set of data However, the yield curve between two and tenyear Treasury bonds correlates with the economic recessions of the past forty years An inverted yield curve appeared about a year before each of these recessionsChart inverted yield curve an ominous the yield curve just inverted putting treasury yield and interest rates the yield curve is triggered does a the yield curve is not signaling aKey Yield Curve Inverts To Worst Level Since 07 30 Year RateTreasury Yields Fall Into The Red As May Decline ContinuesUnderstanding Treasury Yield And InterestDaily Treasury Yield Curve Rates

What Is An Inverted Yield Curve Why Is It Panicking Markets And Why Is There Talk Of Recession

Why Does The Us Yield Curve Inversion Matter

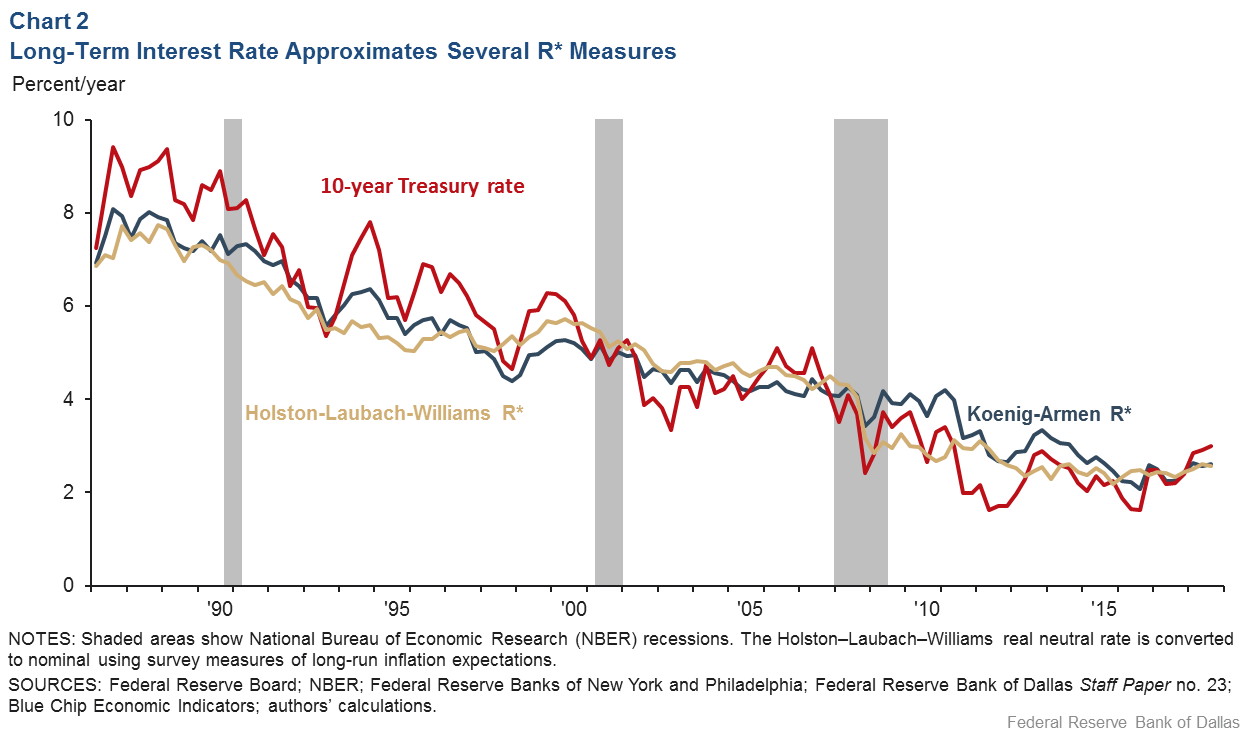

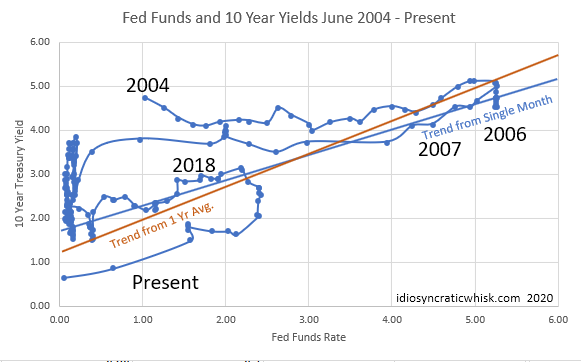

The gap between the 10year US Treasury yield and the fed funds rate has fallen nearly a full percentage point, from 197% at the end of November 16 to 104% as of June 30 But looking at why the yield curve is flattening is just as important as knowing that it is flatteningIndex trading charts all time frames Follow me on Twitter @thinktankcharts Over ,000 Followers Generally, I go over the charts daily AutoSize Charts !This chart provides the US Treasury yield curve on a daily basis It is updated periodically The yield curve line turns red when the 10year Treasury yield drops below the 1year Treasury yield, otherwise known as an inverted yield curve The 19 yield curve chart is archived and available at Daily Treasury Yield Curve Animated Over 19

Inverted Yield Curve Nearly Always Signals Tight Monetary Policy Rising Unemployment Dallasfed Org

Did The Inverted Yield Curve Predict The Pandemic Focus Financial Advisors

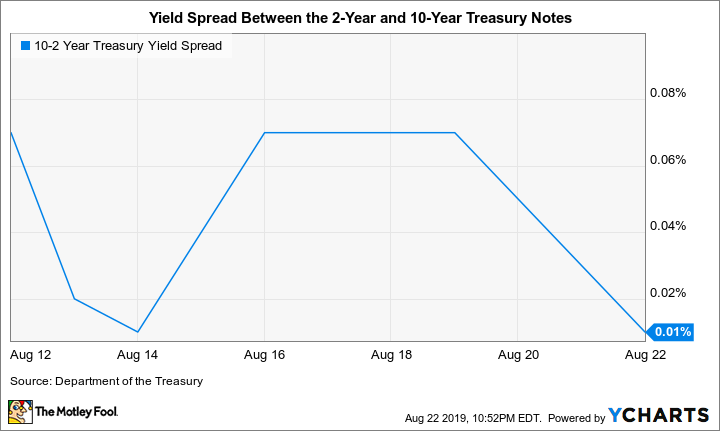

The Tell The US Treasury 210 year yield curve inverted and that means stocks are on 'borrowed time,' says BAML Published Aug 14, 19 at 658 am ETThe following chart from FRED shows that I believe that the entire inverted yield curve is about to revert to positive territory again When we look at the 3year2year treasury yield,The yield curve has inverted before every US recession since 1955, although it sometimes happens months or years before the recession starts Because of that link, substantial and longlasting

Yield Curve Inverted Even More Is It Finally Time For Buying Gold

Animating The Us Treasury Yield Curve Rates

The below chart shows our model, tracking the spread between the 10Year to 3Month US Treasury Yield Curve The inverted curve of 19/ did in fact precede the current recession We've now had several consecutive quarters of normalized rates, indicating market expectations of future growthBackground The yield curve—which measures the spread between the yields on short and longterm maturity bonds—is often used to predict recessions Description We use past values of the slope of the yield curve and GDP growth to provide predictions of future GDP growth and the probability that the economy will fall into a recession overThe below chart shows our model, tracking the spread between the 10Year to 3Month US Treasury Yield Curve The inverted curve of 19/ did in fact precede the current recession We've now had several consecutive quarters of normalized rates, indicating market expectations of future growth

The Yield Curve Is Inverted Why The Hype What Is It And How Does It Impact You Share Picks Usa

Inverted Yield Curve Nearly Always Signals Tight Monetary Policy Rising Unemployment Dallasfed Org

In the US, the yield curve between the threemonth and the tenyear US Treasury inverted some time ago But the big news this week is that the curve between the twoyear and the tenyear has alsoDownloadable chart Chart data Second, the yield curve's slope should be a good predictor of the economy's future strength Sure enough, the unemployment rate tends to fall when the yield curve is steep and to rise (with a lag that is long and variable) when the yield curve is inverted (Chart 4) The transition from unemploymentThe yield curve flattened over the summer as fear swept the market But now as it goes the other way, sentiment may improve in major banking stocks The yield curve is the relationship between the twoyear and 10year Treasury notes People buy 10year notes when they're scared or worried about a recession

Inverse Psychology America S Yield Curve Is No Longer Inverted United States The Economist

Long Run Yield Curve Inversions Illustrated 1871 18

Units Percent, Not Seasonally Adjusted Frequency Daily Notes Starting with the update on June 21, 19, the Treasury bond data used in calculating interest rate spreads is obtained directly from the US Treasury Department Series is calculated as the spread between 10Year Treasury Constant Maturity (BC_10YEAR) and 2Year Treasury Constant Maturity (BC_2YEAR)Yield curves are usually upward sloping asymptotically the longer the maturity, the higher the yield, with diminishing marginal increases (that is, as one moves to the right, the curve flattens out) There are two common explanations for upward sloping yield curves First, it may be that the market is anticipating a rise in the riskfree rateIf investors hold off investing now, they mayS&P 500 Top and Bottom Finder 2 Back to All Public ChartLists report offensive material 10 Per Page View ChartBook View

The Inverting Yield Curve Is About More Than Recession This Time Bloomberg

Is The Yield Curve Signaling A Recession Aug 23 11

Yield Curve as a Stock Market Predictor NOTE In our opinion, the CrystalBull Macroeconomic Indicator is a much more accurate indicator than using the Yield Curve to time the stock market This chart shows the Yield Curve (the difference between the 30 Year Treasury Bond and 3 Month Treasury Bill rates), in relation to the S&P 500 A negative (inverted) Yield Curve (where short term rates are higher than long term rates) shows an economic instability where investors fear recessionary timesThis chart shows the US Treasury yield curve as of Aug 5, 19Normal Yield Curve Interest Rates The chart and the table below capture the yield curve interest rates as available from the US Department of the Treasury The yield curves correspond to five different dates from five different years It can be seen that the yield curve for 29Dec17, 31Dev18, and 31Dec19 are normal in nature

What An Inverted Yield Curve Could Mean For Investors Lord Abbett

:max_bytes(150000):strip_icc()/2018-12-05-Yields-5c081f65c9e77c0001858bda.png)

Bonds Signaling Inverted Yield Curve And Potential Recession

Why Yesterday S Perfect Recession Signal May Be Failing You

Yield Curve Inversion Eight Reasons Why I M Not Worried Yet Early Retirement Now

Yield Curve Gurufocus Com

V8kwijlxtng6tm

A Fully Inverted Yield Curve And Consequently A Recession Are Coming To Your Doorstep Soon Seeking Alpha

Blog

Yield Curve Chartschool

The Yield Curve Inverted In March What Does It Mean Colorado Real Estate Journal

Yield Curve Inversion Econbrowser

Is The Us Treasury Yield Curve Really Mr Reliable At Predicting Recessions Asset Management Schroders

U S Yield Curve Just Inverted That S Huge Bloomberg

Yield Curve Definition Types Theories And Example

My Long View Of The Yield Curve Inversion Wolf Street

Treasury Yield Curve Chart Bloomberg Verse

The Great Yield Curve Inversion Of 19 Mother Jones

Chart Inverted Yield Curve An Ominous Sign Statista

The Inverted Yield Curve Of March 19 Ballast

Yield Curve History Us Treasuries Financetrainingcourse Com

The Great Yield Curve Inversion Of 19 Mother Jones

The Yield Curve Is Not Forecasting A Recession Seeking Alpha

Everything You Need To Know About The Yield Curve Vodia Capital

Beware An Inverted Yield Curve

Explainer Countdown To Recession What An Inverted Yield Curve Means Reuters

A Historical Perspective On Inverted Yield Curves Articles Advisor Perspectives

Free Exchange Bond Yields Reliably Predict Recessions Why Finance Economics The Economist

Recession Watch What Is An Inverted Yield Curve And Why Does It Matter The Washington Post

Yield Curve Wikipedia

Explain The Yield Curve To Me Like I M An Idiot Wall Street Prep

Us 10 Year Treasury Yield Nears Record Low Financial Times

Should You Worry About An Inverted Yield Curve

Q Tbn And9gcriobiz8cr9hdmdodpbctvizf9 Hgdtzrpxz55khh66gogm0csr Usqp Cau

Is The Us Yield Curve Signaling A Us Recession Franklin Templeton

Understanding The Treasury Yield Curve Rates

Yield Curve Wikipedia

The 2 10 Yield Curve And The Shape Of Things To Come Seeking Alpha

Inverted Yield Curve Predictor Of Recession And Bear Market The Wall Street Physician

Gold And Yield Curve Critical Link Sunshine Profits

The Slope Of The Us Yield Curve And Risks To Growth Imf Blog

Yield Curve Inverted Even More Is It Finally Time For Buying Gold

The Shape Of The U S Treasury Yield Curve Colotrust

Long Run Yield Curve Inversions Illustrated 1871 18

The Inverted Yield Curve Is Signaling A Recession These Stocks Could Weather The Storm The Motley Fool

The Treasury Yield Curve And Its Impact On Insurance Company Investments

Is The Fed Tilting The Yield Curve All By Itself Hanlon

The Yield Curve Everyone S Worried About Nears A Recession Signal

Incredible Charts Yield Curve

Key Yield Curve Inverts As 2 Year Yield Tops 10 Year

V8kwijlxtng6tm

Look Beyond The Yield Curve Inversion To Assess A Disturbance In The Market

Yield Curve Inverts Recession Indicator Flashes Red For First Time Since 05

Q Tbn And9gcrya7masp695gheqnwfb1aqqib Vjsojcqchb1b7ypabntywpzc Usqp Cau

Yield Curve Un Inverts 10 Year Yield Spikes Middle Age Sag Disappears Wolf Street

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Gold Prices Yield Curve Inversion Shows Rally In Gold Is Not Over The Economic Times

Does The Inverted Yield Curve Mean A Us Recession Is Coming Business And Economy News Al Jazeera

3

April Update Treasuries Suggest Yield Curve Functionally Inverted Investing Com

/InvertedYieldCurve2-d9c2792ee73047e0980f238d065630b8.png)

Inverted Yield Curve Definition

My Long View Of The Yield Curve Inversion Seeking Alpha

Being On Guard For Curve Inversion Marquette Associates

Us Yield Curve Looks Hell Bent On Inverting Flattest Since Aug 07 Wolf Street

Trading 101 The Inversion Of The Us Treasury Yield Curve

What Does Inverted Yield Curve Mean Morningstar

Why Does The Yield Curve Slope Predict Recessions Federal Reserve Bank Of Chicago

Animating The Us Treasury Yield Curve Rates

As The Yield Curve Flattens Threatens To Invert The Fed Discards It As Recession Indicator Naked Capitalism

It S Official The Yield Curve Is Triggered Does A Recession Loom On The Horizon Duke Today

5 Things Investors Need To Know About An Inverted Yield Curve Marketwatch

The Inverted Yield Curve Is Signaling A Recession These Stocks Could Weather The Storm The Motley Fool

History Of Yield Curve Inversions And Gold Kitco News

What Information Does The Yield Curve Yield Econofact

The Yield Curve In Relation To Inflation Rjo Futures

Recession Warning An Inverted Yield Curve Is Becoming Increasingly Likely Not Fortune

Yield Curve Economics Britannica

10 Year Treasury Constant Maturity Minus 2 Year Treasury Constant Maturity T10y2y Fred St Louis Fed

Us Recession Watch What The Us Yield Curve Is Telling Traders

Is The Flattening Yield Curve A Cause For Concern Morningstar

Daily Treasury Yield Curve Animated Over 19 Fat Pitch Financials

コメント

コメントを投稿